Welcome to

Assets Aims Consultant Private Limited

At Assets Aims, we strive to foster equal opportunities for everyone.

We approach your queries with an open mind and provide comprehensive solutions to address them effectively.

Our Company

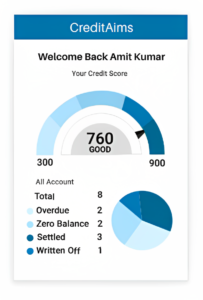

Credit Aims ensures a comprehensive approach to resolving credit-related issues. If you are looking for tailored financial solutions, Credit Aims is committed to fostering equal opportunities and delivering the support you need.

Listed Services

Credit Aims provides a range of services related to credit scores, credit reports, and credit counseling. By offering these services, Credit Aims aims to empower individuals with the knowledge and tools necessary to take control of their credit, improve their financial standing, and achieve their financial goals.

Get a Quote

By filling out the form, you allow us to better understand your needs, enabling us to provide you with a comprehensive quote tailored to your requirements. Our dedicated team will review your details and promptly get back to you with the information you need.

Our Services

Credit Score & Report

We offer comprehensive insights into your credit health, empowering you with the knowledge to make informed financial decisions.

Analysis of Credit Report

Our service provides a thorough examination of your credit history, highlighting key factors that impact your creditworthiness and offering actionable recommendations.

Credit Counselling

We offer personalized guidance and expert advice to help you manage your debts, improve your credit, and achieve financial stability.

How We Work

Your credit report undergoes analysis by our team.

Our Credit Report analysis helps you make well-informed decisions about Credit and provides assistance with checking your free Credit Score online, regardless of your specific Credit concerns.

Our services for Credit Report Analysis assist you with the following:

- Acquire knowledge on the necessary steps to enhance your Credit Score.

- Discover effective strategies to rapidly increase your Credit Score.

- Gain insights into the advantages of having a good Credit Score.

- Explore online Credit repair services and how to access them.

- Learn techniques for improving your Credit Score after experiencing defaults.

- Learn the process of obtaining your Credit Report.

Our team of Credit experts will guide you on improving your Credit Profile and increasing your Credit Score following a default.

We address and resolve issues that impact your Credit Score.

A committed Credit Expert collaborates closely with you to rectify any inaccuracies found in your Credit Report. Inaccurate information within your Credit Report has the potential to decrease your Credit Score and hinder your eligibility for new loans or Credit cards. Additionally, it can result in higher interest rates and less favorable loan terms and conditions. Fortunately, there are several steps you can take to dispute errors present in your Credit Report. These may include addressing identity errors such as incorrect name or address, rectifying inaccurately reported loan account statuses, and resolving data reporting errors. Other mistakes that can be addressed include inaccuracies in balance or credit limit information, such as a low limit or incorrect current balance.

At Credit Aims, our Credit Expert customizes a personalized program aimed at enhancing your Credit profile.

Based on your Credit profile, we provide tailored recommendations for the most suitable solutions.

Our team offers expert recommendations to address all your Credit issues. Having a good Credit profile facilitates easy and hassle-free access to loans.

No matter what your specific needs are, we have a solution for you. Whether it’s improving your Credit Score after a default or conducting a Credit history check, our experts provide valuable guidance. If you’re a first-time personal loan applicant, our team shares top tips for increasing your Credit Score. For those seeking instant loans, we ensure instant loan approval with minimal risks.

Got a Question?

Your credit report reflects your complete credit history. It consists of all your credit cards, loans from banks or NBFCs, along with the limits, spending and payment history.

Credit scores between 580 and 649 are regarded as fair, 650 to 799 as good, and above 800 as exceptional.

No, checking your personal credit score do not impact it. Rather, it is recommended to do a check to ensure a good health before you apply for a loan or credit card.

Yes, you must check your credit score to avoid applying for a loan in case it may get rejected. You can better prepare and resolve issues if you are aware of your score beforehand. Moreover, you might attempt to raise your credit score if it is low before requesting a loan.